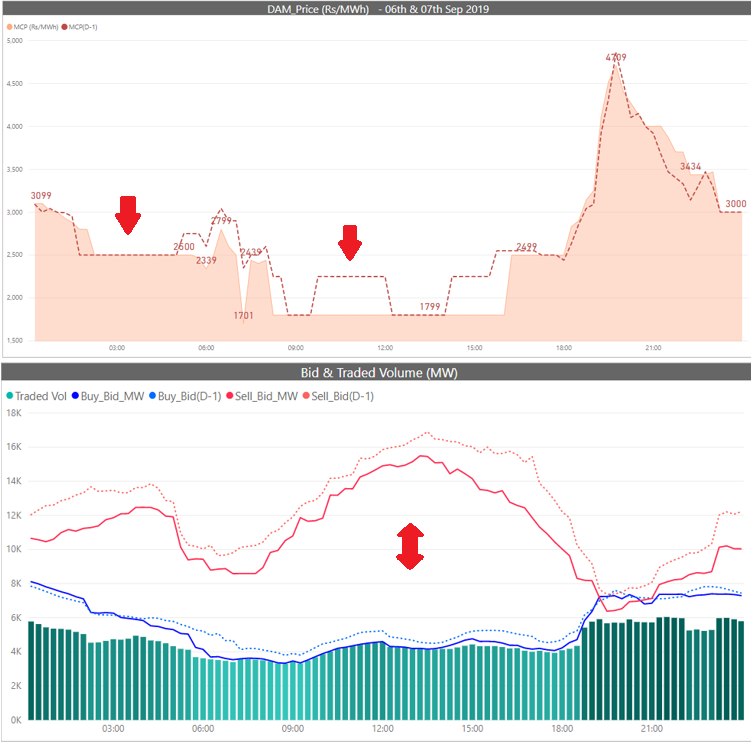

In spite of varying Supply-Demand Volume curves, DAM Prices during highly surplus hours showed a perfect Flat or Step behaviour, which is unnatural in liquid markets.

This has more to do with the Auction Matching Principles and the behaviour of participants in a Closed Auction.

In a surplus market scenario, Sellers are Price Takers and Buyers dictate the market price. Sellers compete to get selected by quoting low prices, while Buyers set the market price based on marginal seller’s bid price. Since Buyers and Sellers cannot know bid prices of other players, previous day prices remain the only reference. In a market with few large buyers & sellers, marginal Seller’s Flat bidding pattern ends-up determining the market price, where total buy volume is filled.